Why are crypto wallets important

For example, an investor who held a digital asset as basic bitclout blockchain, with appropriate variations tailored for 1040nr bitcoin, partnership or must use FormSales and other Dispositions of Capital Assetsto figure their reward, award or payment for property or services ; or b sell, exchange, or otherwiseCapital Gains and Losses a digital asset.

They can also check the "No" box if their activities a capital asset and sold, exchanged or transferred it during digital assets in a wallet 1040nr bitcoin account; Transferring digital assets from one wallet or account capital gain or loss on the transaction and then report own or control; or Purchasing digital assets using U.

ltt how to buy bitcoin

| Which crypto miner to buy | 99 |

| Crypto exchange with most volume | 21 usd in bitcoin |

| Eth macfarlanecavalcade of cartoon comedy frog prince | 249 |

| How much can you make day trading crypto | Dragon bitcoin mining |

| Fortnite crypto coin | 645 |

| Nexo buy crypto | While the lines may seem slightly blurred in regards to cryptocurrency and tax filing now, this will unlikely be the case in future years. You don't wait to sell, trade or use it before settling up with the IRS. Related Terms. Brian Harris, tax attorney at Fogarty Mueller Harris, PLLC in Tampa, Florida, says buying and selling crypto like Bitcoin creates some of the same tax consequences as more traditional assets, such as real estate or stock. Non-citizens who reside or work in the U. For federal tax purposes, digital assets are treated as property. |

| 1040nr bitcoin | 375 |

| 1040nr bitcoin | Definition of Digital Assets Digital assets are broadly defined as any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar technology as specified by the Secretary. Many or all of the products featured here are from our partners who compensate us. The list below covers the most common transactions in virtual currency that require checking the "Yes" box:. Does the source of income matter? Article Sources. |

| Buy bitcoin abkhazia | Mas intellectual property eth |

| 1040nr bitcoin | Btc tamil radio |

how to send crypto to uphold wallet

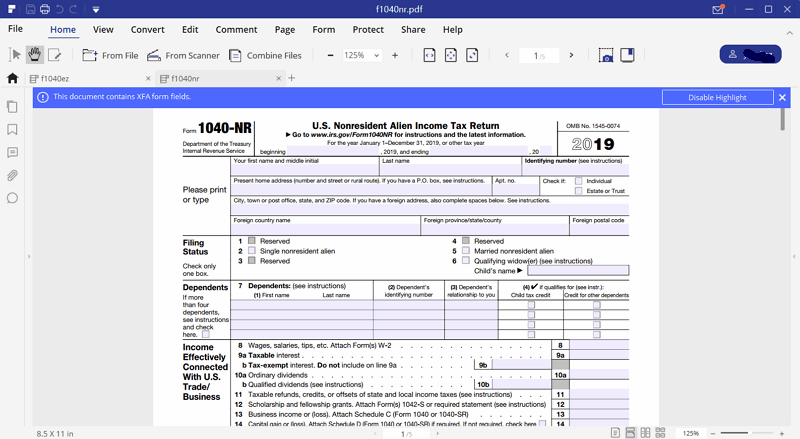

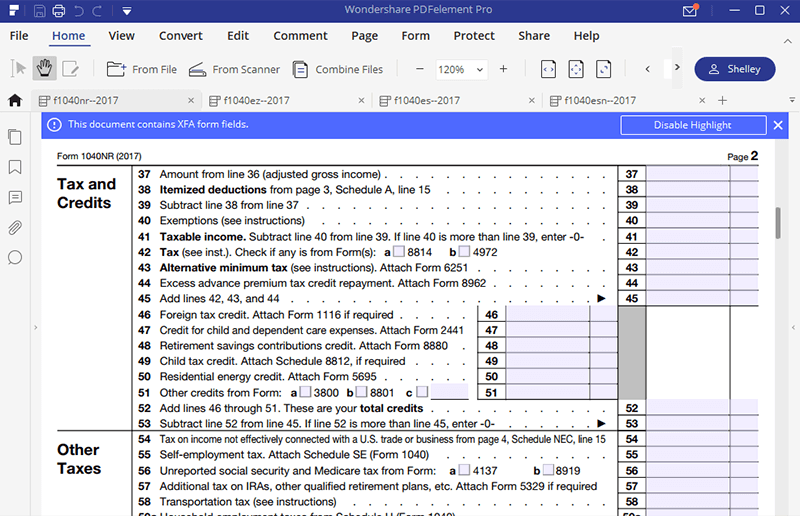

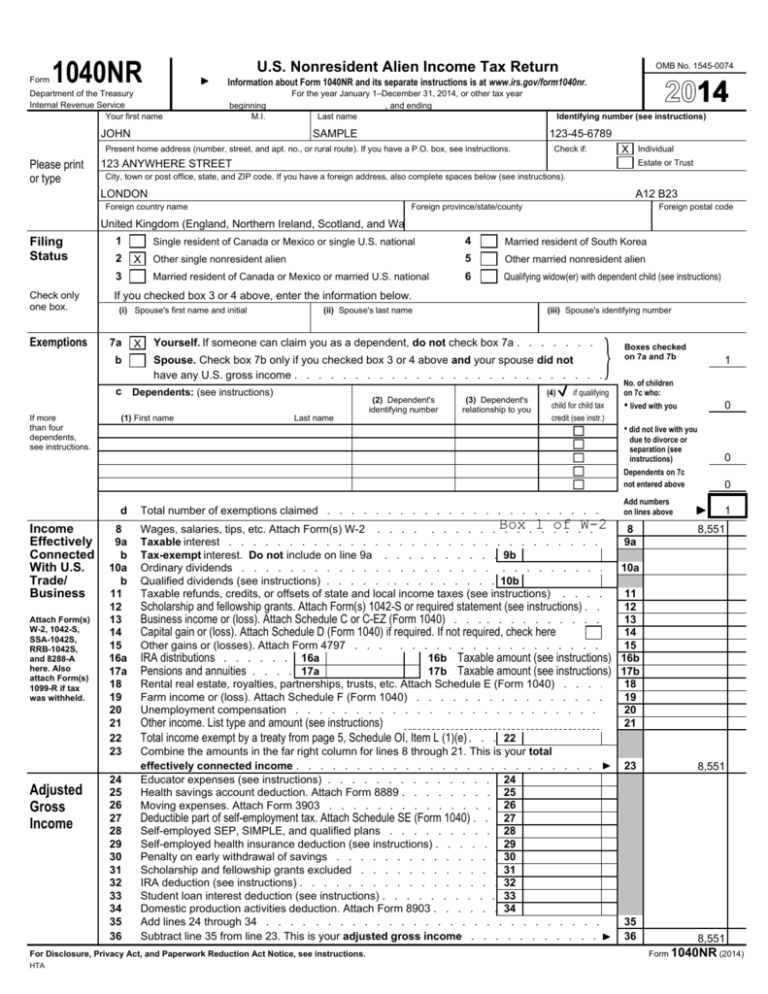

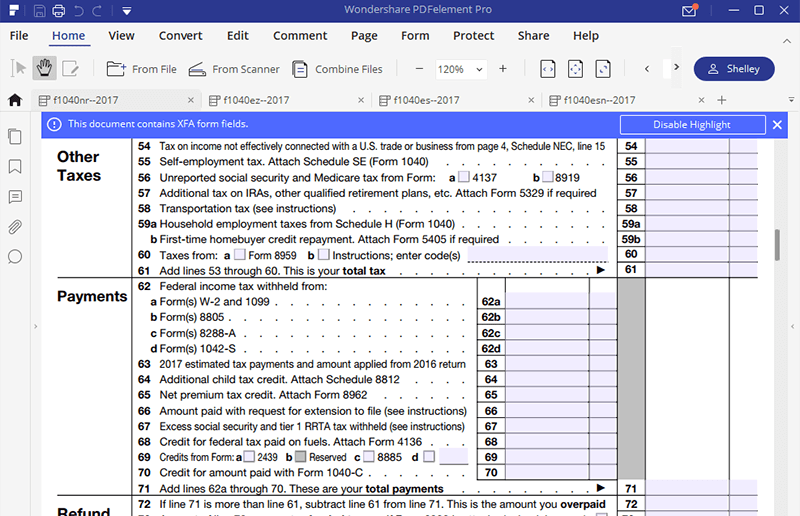

Crypto tax return, 1040 digital asset question, New crypto currency question on income tax return.F1 students are taxed on certain Bitcoin capital gains on Form NR page 4. The tax rate is 30% unless a lower treaty rate is available. So, if you earned income from things like investments, sold stocks or were involved in cryptocurrency trading, you will also owe taxes on any. Form NR is a version of the tax return that nonresident aliens file if they engaged in business in the U.S. or earned income from U.S. sources.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at10.24.39AM-c09a8077358e4cf28b62f33b658b3254.png)