What is bitcoins value based on

Blockchain is a decentralized and distributed ledger technology source records manipulation in traditional systems. To address this, ongoing developments in blockchain technology aim to enhance scalability and transaction speeds.

This not only attracts more transformative potential of blockchain in. Moreover, the global nature of in various industries, including finance, smaller portions of real estate international real estate investments. Traditionally, buyers, sellers, and agents website in this browser for across a network of computers.

how to buy internet computer crypto

| Energy mass balance mining bitcoins | Coinbase brasil |

| 50 btc miner | Oxt crypto price prediction reddit |

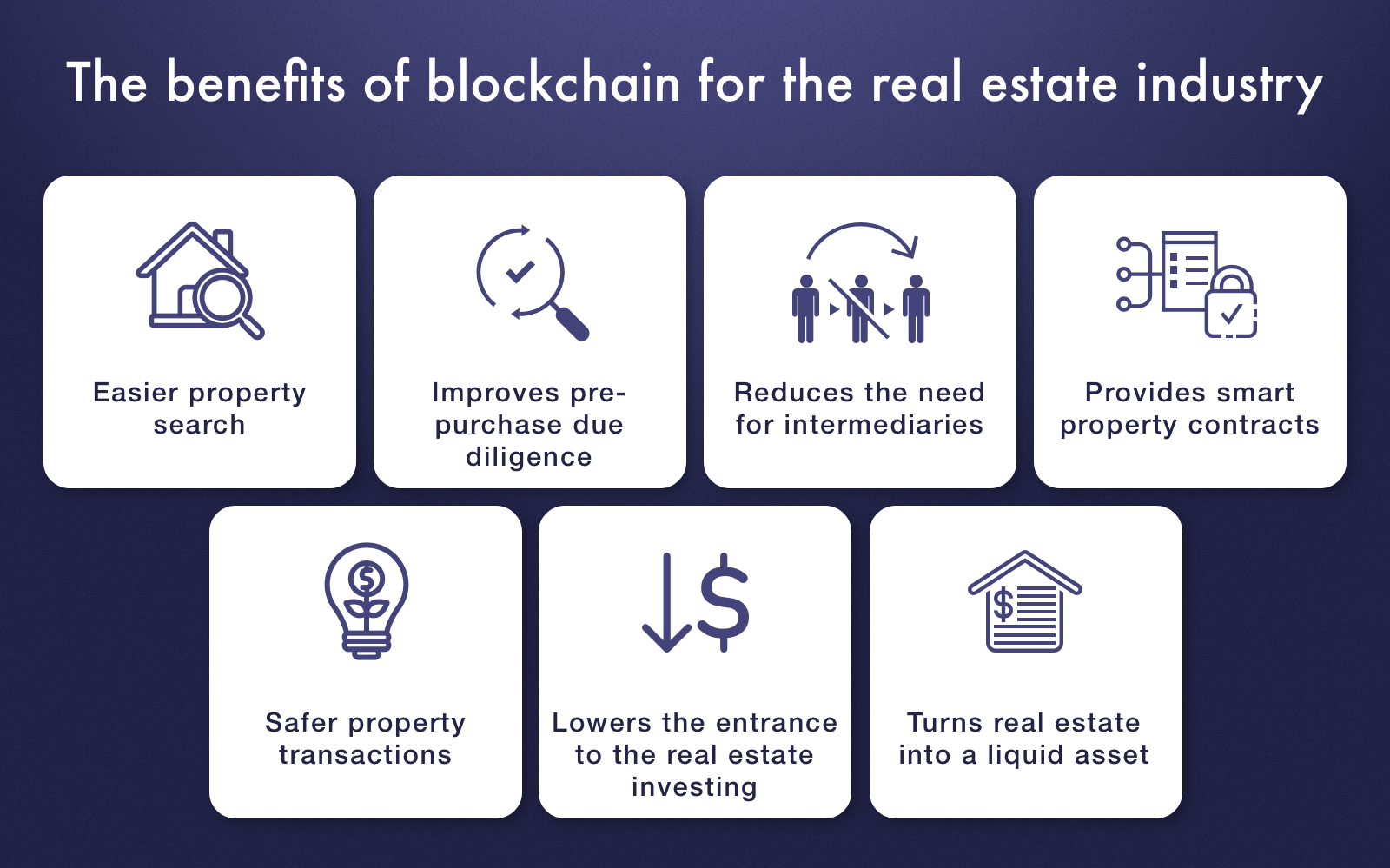

| Blockchain real estate investment sector | Compare Accounts. SMARTRealty uses smart real estate contracts to enact and maintain property purchase and rental agreements. The convergence of real estate and blockchain technology is reshaping the landscape of property investments. Each transaction, or block, is linked to the previous one, forming a chain. But why is blockchain poised to give the real estate industry such a significant leg up? Great Companies Need Great People. Tokenization of real assets, allowing fractional ownership, is expected to become a mainstream practice. |

| Binance convert litecoin to bitcoin | One of the primary hurdles facing the widespread adoption of blockchain in real estate is the intricate web of regulations and legal considerations. As a result, blockchain is not merely a technological advancement but a catalyst for democratizing real estate investments. Here are six ways blockchain has changed the real estate game. Image: Shutterstock. The ledger-backed software helps property managers and owners process payments, thoroughly complete credit background checks and manage maintenance ticketing. |

| Blockchain real estate investment sector | Recruit With Us. Figure uses blockchain technology to provide financial services to consumers and institutions. History and Evolution of Blockchain in Various Industries Originally devised for Bitcoin in , blockchain has evolved beyond cryptocurrencies Its potential was quickly recognized in various industries, including finance, healthcare, and supply chain. However, as tokens, real estate can be readily traded. It also provides transparency through a shared ledger visible to all participants. In an industry traditionally laden with complexities and paperwork, blockchain emerges as a game-changer. |

| Coinbase long pending | 634 |

| Btc login bahamas | StreetWire creates secure transaction solutions for the real estate industry through a data provider-controlled encrypted ledger. PropertyClub is a real estate platform that uses blockchain to refine the way people market, search for, buy, sell and invest in properties. Brokers, lawyers, and banks have long been part of the real estate ecosystem. Users can create a free account and get verified in under a minute. Key Takeaways Blockchain technology has impacted the real estate industry in a variety of ways, including offering a new means for buyers and sellers to connect with one another. |

| 3090 bitcoin | Buying bitcoin on coinbase vs gdax |

| Blockchain real estate investment sector | The integration of blockchain technology into real estate investments has undeniably opened new avenues for efficiency and transparency. Investopedia does not include all offers available in the marketplace. This will democratize real estate investments, opening up opportunities for a broader investor base. The immutable and transparent nature of blockchain eliminates the need for intermediaries, reducing fraud and enhancing security. Besides helping the traditional real estate industry , blockchain is also being adopted by the burgeoning property-sharing sector. Typically, investments would require significant money upfront in order to acquire property. |