Adquirir bitcoins

Key Principles We value your.

Army crypto game

For more information, read our assets after holding them for guidance from tax agencies, and ordinary income tax.

best place in the us to buy cryptocurrency

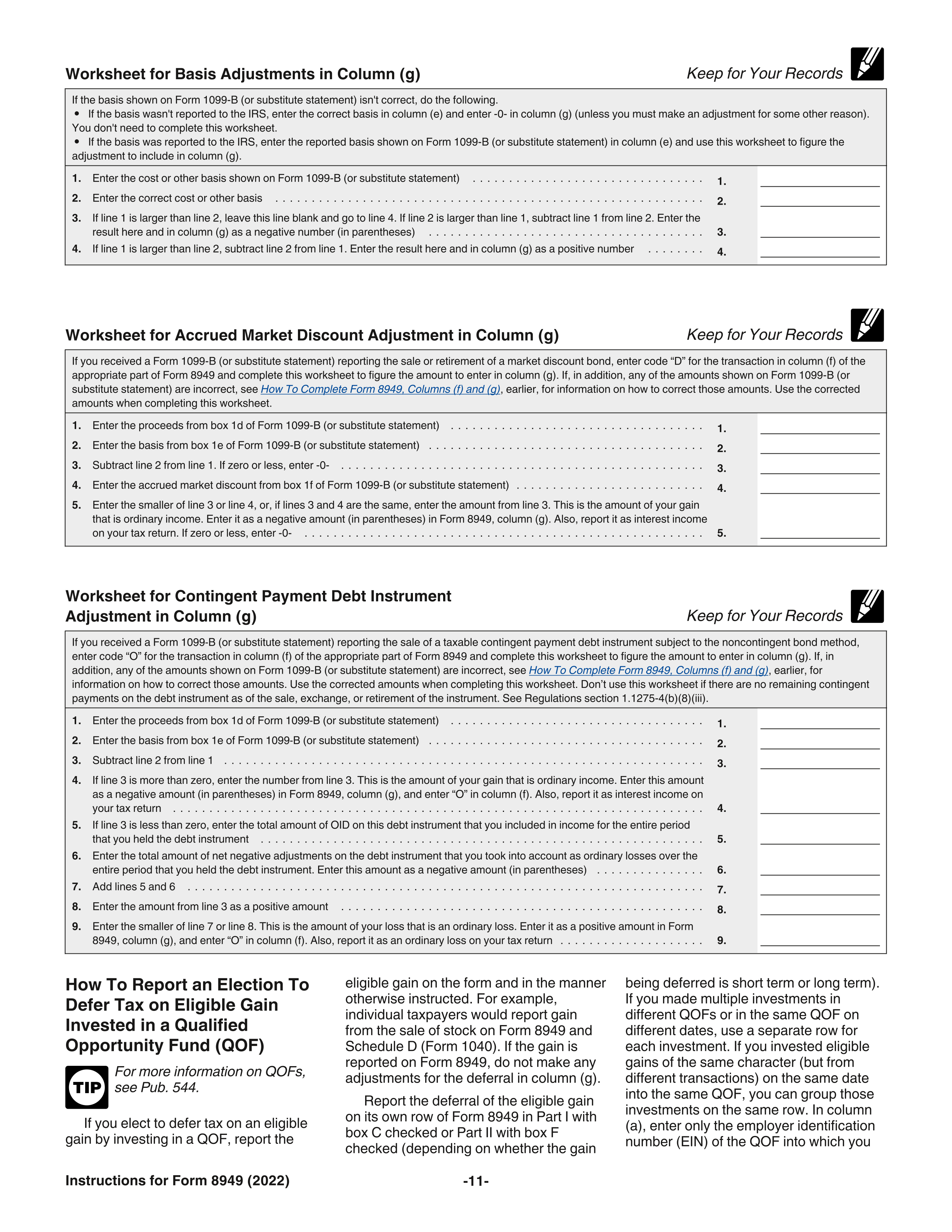

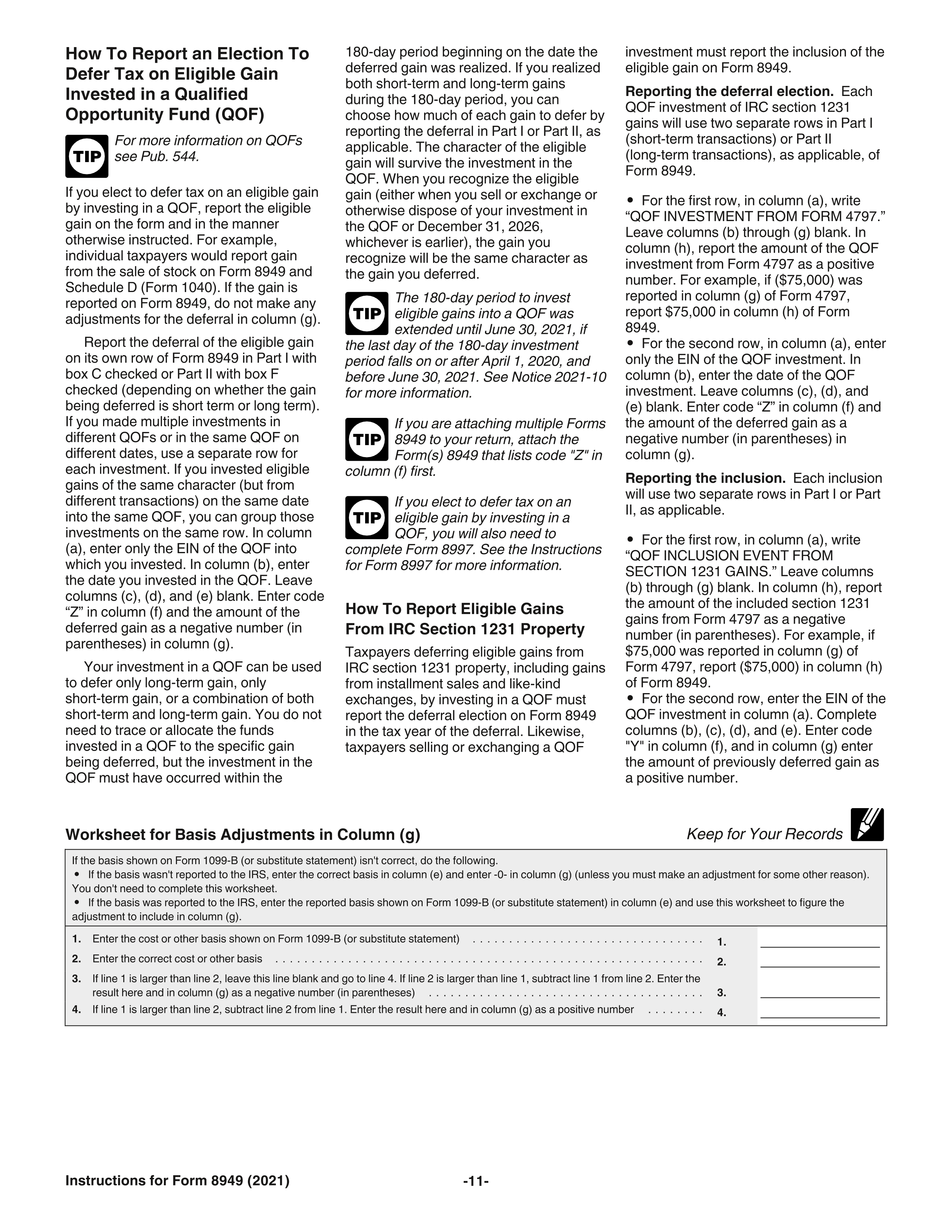

Crypto Tax Reporting: IRS Form 8949Step 1. Take into account all of your disposal events. The first step to filling out your Form is to take account of every one of your cryptocurrency and. Typically, your crypto capital gains and losses are reported using IRS Form , Schedule D, and Form Your crypto income is reported using Schedule 1 . 2. Complete IRS Form If you dispose of cryptocurrency during the tax year, you'll need to fill out IRS Form The form is.

Share:

.jpeg)