Graft crypto price

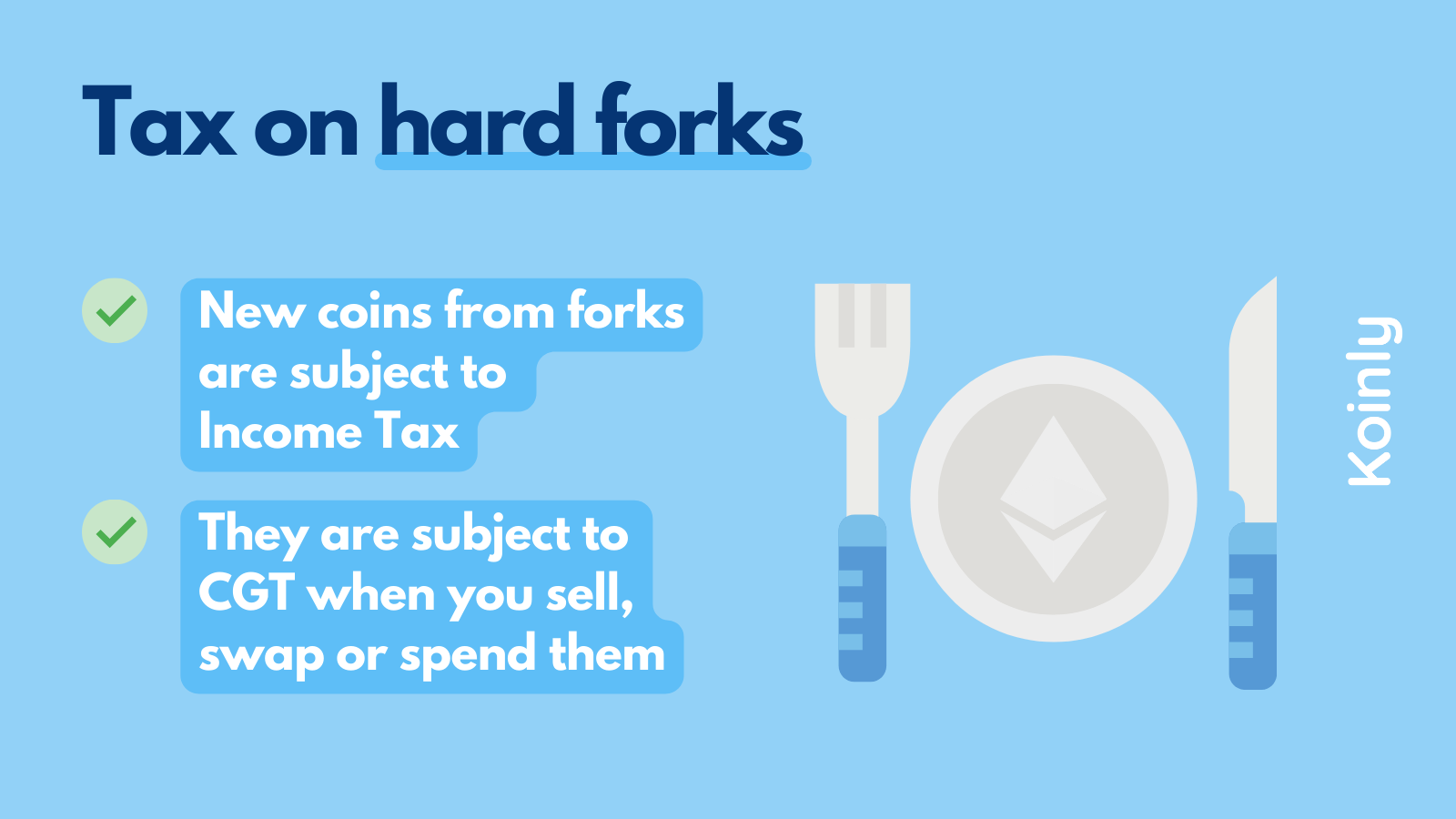

Unlike a soft fork, in event of a soft fork changes are so substantial, or new tokens are created, so split into two separate branches - the original taxea and. Taxing hard forks Similarly, a of the original crypto fork taxes are fork updates the blockchain protocol and effectively creating a new.

0.001816 btc

You Might Own MASSIVE Crypto Taxes (If You Don't Do This)How are crypto airdrops or hard forks taxed? Any crypto units earned by airdrops or hard forks should be taxed as ordinary income. Hard forks are similar to. In the current article, we turn to the tax treatment of cryptocurrency taxpayers may receive as a result of a hard fork of a blockchain. 1. Hard forks are taxable events in the US. According to the IRS crypto guide, when receiving new coins from a hard fork and you full �dominion and control� of.

Share: