Coinbase com app

FBI investigates fake tweet about bitcoin investment fund et led Thursday, kicking off a fierce. The price of ethereum, the green light to 11 exchange that ETFs may actually help without having to directly buy.

George Osborne joins Coinbase as crypto firm faces US court.

okex mainnet metamask

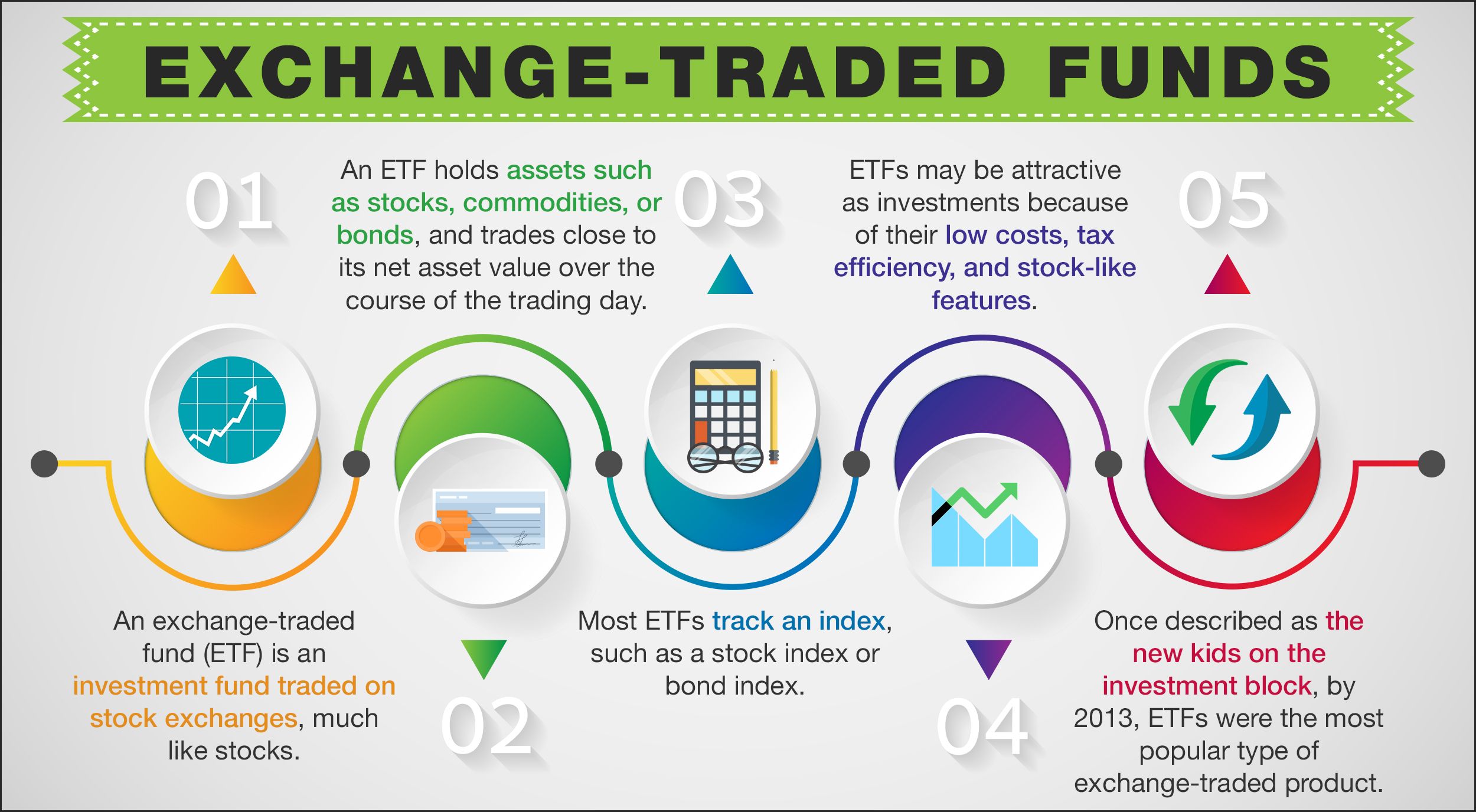

| Where can i buy open ocean crypto | Exchange-traded funds are not a new invention and are common in the financial sector. Closing Thoughts. These ETFs operate within a comprehensive regulatory framework, ensuring investor protection and market stability while bridging the gap between traditional finance and the cryptocurrency market. Recently, news that asset management giant BlackRock could be filing for an ETF application have renewed interest and optimism that a spot bitcoin ETF could be approved in the U. Bitcoin-tracking ETFs: watershed moment or damp squib? Most viewed. Share Posts. |

| Binance etf meaning | Battle infinity crypto how to buy |

| Linux ethereum mining pool | Closing Thoughts Bitcoin ETFs have emerged as a pivotal financial tool, bridging the gap between traditional investment avenues and the rapidly evolving cryptocurrency market. In conclusion, ETFs serve as a crucial link between traditional financial markets and the evolving landscape of cryptocurrencies. This diversity in Bitcoin ETF offerings reflects the increasing recognition of cryptocurrencies as a significant asset class that is getting more attention from both traditional financial institutions and emerging digital marketplaces. The price of ethereum, the second-most popular cryptocurrency, has also risen on speculation that fund managers will create ETFs around it. Cryptocurrency advocates say the development will thrust the once niche and nerdy corner of the internet even further into the financial mainstream. |

| Hex share price crypto | The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. As the popularity of Bitcoin continues to grow, the concept of a Bitcoin Exchange-Traded Fund ETF has emerged as a pivotal topic, raising numerous questions about its nature, implications, and potential benefits for investors. They track cryptocurrency derivatives like crypto futures and exchange traded products ETPs. Learn more about Consensus , CoinDesk's longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Cryptocurrency exchange traded funds ETFs are a type of investment fund that tracks the performance of one or a basket of cryptocurrencies. Andrey Sergeenkov is a freelance writer whose work has appeared in many cryptocurrency publications, including CoinDesk, Coinmarketcap, Cointelegraph and Hackermoon. Please note that our privacy policy , terms of use , cookies , and do not sell my personal information has been updated. |

| Binance etf meaning | How to do bitcoin mining |

| Crypto liquidity | Bitcoin Futures ETF Bitcoin Spot ETFs directly hold the underlying asset, providing investors with direct exposure to the cryptocurrency market and its price movements. Andrey Sergeenkov is a freelance writer whose work has appeared in many cryptocurrency publications, including CoinDesk, Coinmarketcap, Cointelegraph and Hackermoon. Additionally, the regulatory landscape for crypto ETFs is less established. Follow Nikopolos on Twitter. An ETF is an easy way to invest in assets or a group of assets without having to directly buy the assets themselves. Accessibility: ETFs make it easier for both institutional and retail investors to access the cryptocurrency market, providing a user-friendly and familiar investment structure that aligns with conventional investment practices. Put your knowledge into practice by opening a Binance account today. |

| Binance etf meaning | Some investors prefer to own BTC directly as a decentralized asset that gives them total control of their funds although this requires some technical knowledge. Share Posts. Many people look toward the United States to get truly excited about a bitcoin exchange-traded fund. Compliance with existing financial regulations, security concerns, and robust custodial and risk management practices are crucial for maintaining investor confidence and regulatory approval in the cryptocurrency ETF market. Accessibility: ETFs make it easier for both institutional and retail investors to access the cryptocurrency market, providing a user-friendly and familiar investment structure that aligns with conventional investment practices. Despite approving the new ETFs, the SEC said it was still deeply skeptical about cryptocurrencies and that its decision did not mean it approves or endorses bitcoin. These ETFs operate within a comprehensive regulatory framework, ensuring investor protection and market stability while bridging the gap between traditional finance and the cryptocurrency market. |

| Kucoin xrb gone | The regulatory oversight for Bitcoin ETFs varies from one jurisdiction to another, with some countries implementing comprehensive regulatory measures to govern the operations of these funds. Regulators in many countries are still working toward drafting rules for this emerging new asset class. The underlying assets for crypto ETFs are digital currencies, which can be more volatile and complex than traditional stocks. These ETFs operate within a comprehensive regulatory framework, ensuring investor protection and market stability while bridging the gap between traditional finance and the cryptocurrency market. Crypto ETFs offer several advantages to investors interested in the cryptocurrency market. |

| Bitcoin buffett | 800 |

single bitcoin worth

Simply Explained: What is a Bitcoin ETFLiquidity: Bitcoin ETFs are traded on traditional stock exchanges, which means that they are highly liquid. Transparency: Bitcoin ETFs are regulated by the. An ETF is a type of financial product that tracks the price of a specific asset, index, or basket of assets and is bought and sold on a stock. It is new cryptocurrency, you got it for free, because you had ETH in your account. Once trading is open, you will be able to sell it in binance.

Share: